Circle Three 86 / I’ll be There

I had big plans to do some original writing this week, but it was such a sunny, warm weekend that my attention was put elsewhere — largely on being outdoors with friends — so here I am finishing this on Sunday night.

This week is short and focused on business/tech, but I’ve been reading and thinking a lot about the role of religion, and how that might play into a future with AI as I linked last week. I’ll write more next week.

Contents:

brain bites: Business & Investing

Startup Growth and Venture Returns

Stepping up: Becoming a high-potential CEO candidate

brain bites: Technology

The Warburg Serres Investment Thesis, Part 1

Lyric: I’ll Be There by The Jackson 5

brain bites: business & investing

Startup Growth and Venture Returns. A report from AngelList concludes “with an argument rooted in social equity for why retail investors should have access to a broad-based index of early-stage venture investments.”

The model demonstrates how the power law distribution present in start-up investing has created a wealth-generating mechanism that is not in reach of most retail investors. I’m trying to better understand power-law dynamics and found this to be a useful example application.

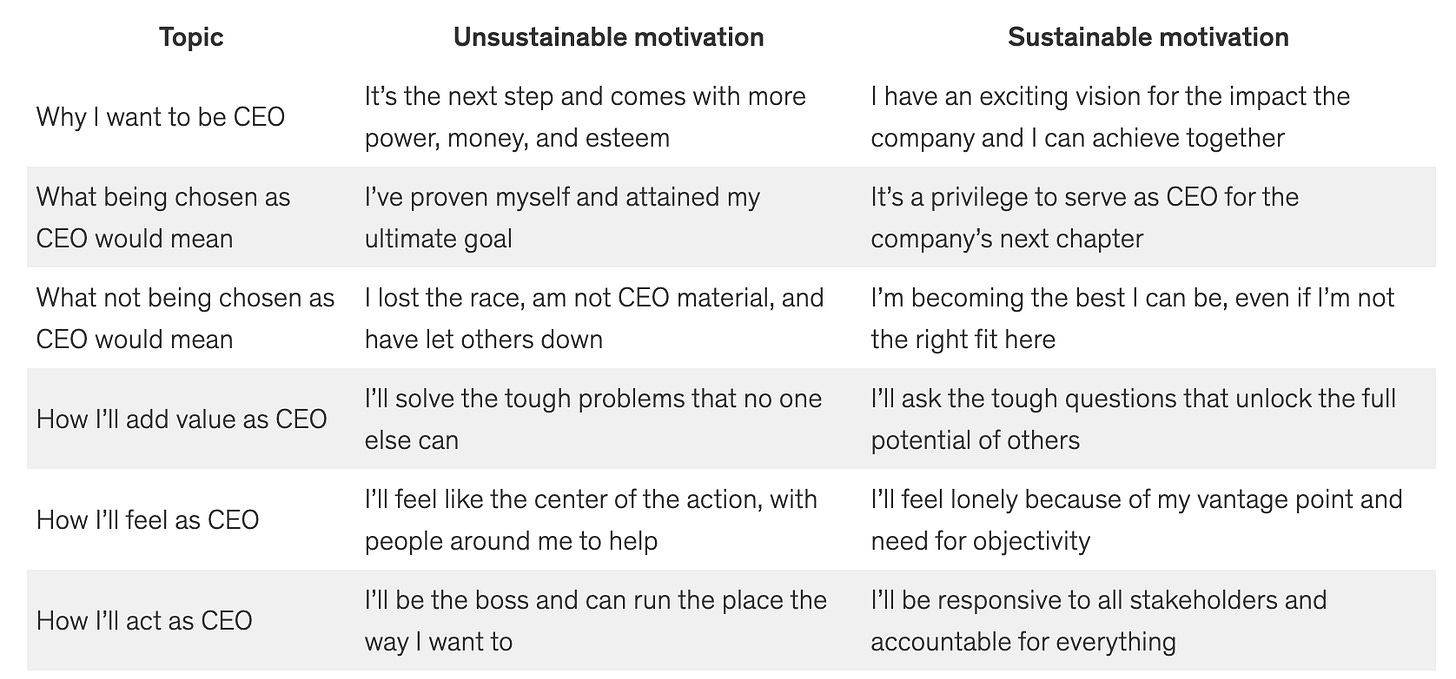

Stepping up: Becoming a high-potential CEO candidate. A McKinsey article. One section applicable to all careers: take a gut check of your motivations and expectations. It’s easy to glorify the CEO role, but this table gets at very real aspects that I’ve seen take hold and propel to success or cause burnout.

brain bites: technology

The Warburg Serres Investment Thesis, Part 1. Tom Serres writes his web3 venture thesis, emphasizing infrastructural investments over peak investments at the beginning of new technological development. I believe the thesis applies to crypto as well: the infrastructure being built will be the foundation for the next “huge concepts.”

You are a focused professional, with one goal: you want to maximize returns on a concept you know is going to be huge in less than a decade: internet video.

So where do you invest your dollars?

“YouTube, of course,” you probably think, smugly.

But here’s the catch: YouTube doesn’t exist yet. And in fact, it can’t exist yet. The technology just isn’t there yet. The closest thing that you have are smatterings of flash animation here and there. (And we all know how awesome that was –– until it wasn’t!) Because for YouTube to exist, many other things first have to be true.

All that money you think you want to plow into “YouTube,” which is still a glimmer in someone’s eye, you really want to invest in AKAM, which in 2003 is trading around just a dollar a share on Nasdaq. Just a few years later, as YouTube is just finally becoming widely known, AKAM trading around $55.

By playing it smart and betting on the right foundational provider implicated in internet video technology, you’d have a 5,500% return on your 2003 investment in AKAM.

Lyric: I’ll Be There by The Jackson 5

Saturday night, I watched a band at a Sofar concert with a 17-year-old guitar prodigy. “Backstage” before the show (aka in line for the bathroom), the lead singer used the word prodigy. I laughed it off, but was absolutely floored after the performance later that night.

It had me thinking of MJ, another child music prodigy. This is a personal favorite.

The Jackson household was strict. The kids weren’t allowed many outside interests, but the father saw music as a way out of Gary, Indiana. While the show Saturday was incredible, it’s easy to equate ‘prodigy’ with ‘natural,’ leaving out the hours and discipline behind the raw skill.

And oh, I'll be there to comfort you

Build my world of dreams around you, I'm so glad that I found you

I'll be there with a love that's strong

I'll be your strength, I'll keep holding on

Stay Curious,

Dan